Going abroad and wondering how to avoid currency conversion fees or extra commissions? After your holiday trip, you have a lot of foreign coins in your pocket, which you do not know what to do with? For us, it has always been a problem and we have always been looking for the most optimal solution. A few years ago we found something that, in our opinion, is close to the ideal – Revolut. Read our article – Revolut – what is it and how to use it. At the end of the article, we placed a link that allows you to create account and receive your Revolut card for free.

How were we doing before we hit the Revolut card?

Usually, we took other currencies with us because it was the safest and cheapest way. Card payments, settled in PLN, were very expensive due to currency conversion and additional fees charged by the bank, so sometimes we used it, and we treated it as a necessary “evil”. There was still a foreign currency account with a payment card, but there is also a problem because usually such accounts are also burdened with commissions and support only one foreign currency. And so we found Revolut, which is great if you are aware of its disadvantages.

Revolut – what is it and how to use it

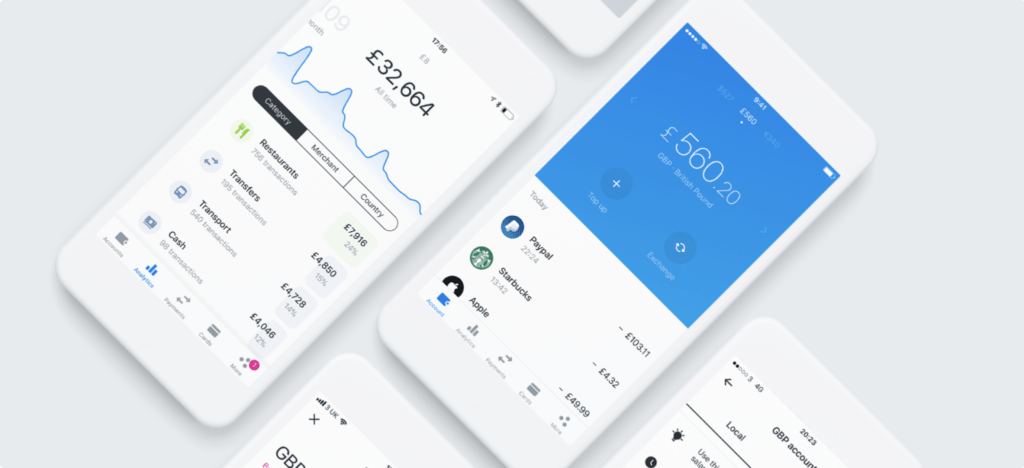

Revolut is a prepaid service implemented through the phone application. It is important to be aware that the card is issued by a British company which, at the moment, is not yet a bank, despite being granted a European banking license in 2018. Let no one come up with the idea of keeping all of the money there. With Revolut, you can change your money into 24 different currencies without additional commission. The conversion is done at the interbank rate. Do we need 415.25 Czech crowns because exactly that many we have to pay at the gas station in the Czech Republic? A few clicks, maybe 10 seconds and a specific amount we have prepared on our payment card. What’s more, Revolut allows you to automatically fund your account if your balance falls below a certain amount. We can always be sure that we will not run out of funds on our account. Unfortunately, we have a choice only from predefined amounts.

Revolut – what you need to have to begin using Revolut

All you need is an Android or iOS phone, on which you need to download and install the Revolut application. The next step is to determine the PIN number for the application, send a photo of your identity document, in order to verify it and connect to the payment card application, from which you need to make the first top-up of 20 PLN. Then, after verifying the document, we fill in our contact details and order a payment card, which will come by the Post Office after about 7-10 days. If you use our link, which you can find at the bottom of this article, you will receive the card for free.

Revolut – types of available accounts

- Standard

- Premium

- Metal

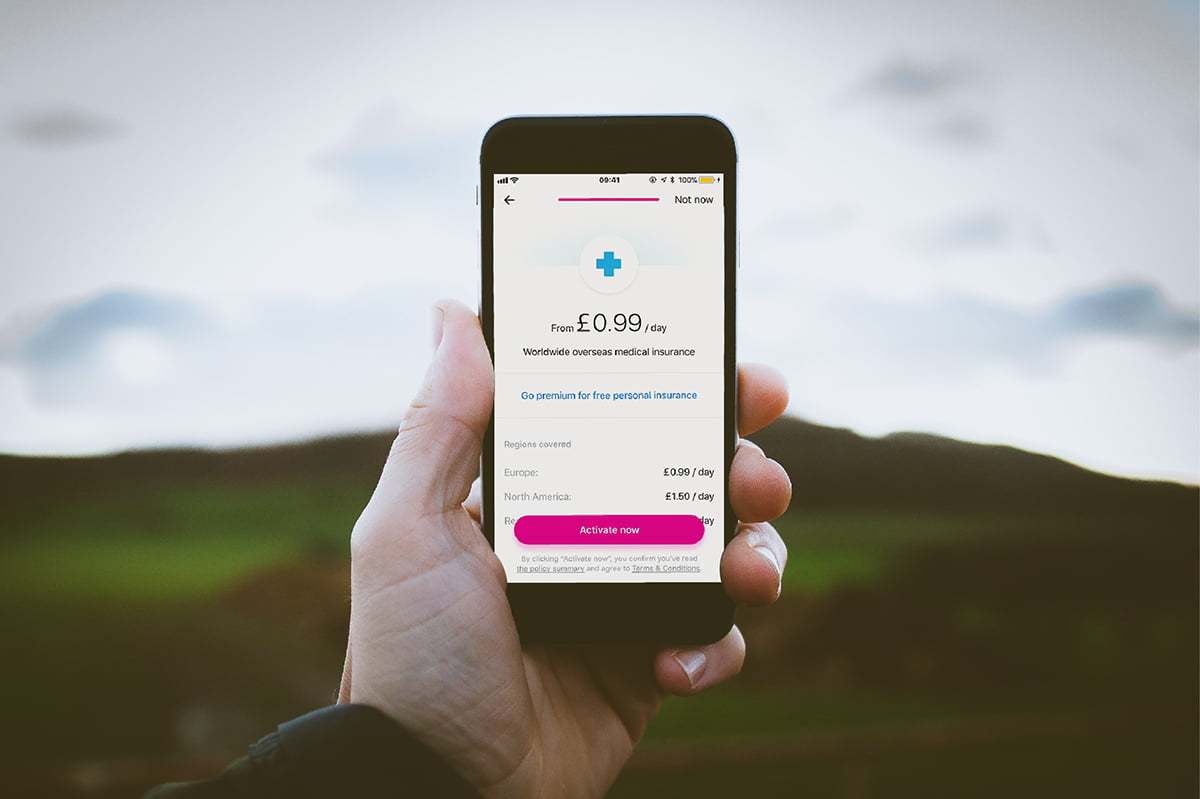

We use the Standard account, which is fully free of charge, but there are certain restrictions, such as the limit of monthly free withdrawals from ATMs abroad. It is the equivalent of 200 €. However, the limit for monthly currency exchange on your account is 20.000 PLN (4.500EUR). For us, it is fully sufficient, but if you are not satisfied with that, you can choose a paid monthly account of £6.99 (Premium version) or £12.99 (Metal version). In addition to the increased limits, there are also bonuses such as health insurance, baggage insurance in case of loss, or virtual payment cards with a variable number.

Revolute – how expensive is it?

Opening an account is free of charge, however, in the case of a Standard account, you have to pay 9.90 PLN (about 2,50EUR) for a payment card. This is a standard fee if you do not use the referral links or other promotions. Do you want to collect your Revolut card for free? Use our link. What else? Nothing – if we do not exceed the limits assigned to the account, we do not pay any additional fees, but after they are exhausted, a percentage fee is charged on the transaction:

- for ATM withdrawals, 2%,

- for card payments – 0.5%.

So far we have used Revolut in Austria, Czech Republic, Italy, Switzerland, Croatia, Montenegro, Albania, Serbia, Romania, Iceland, and many other European countries. We paid easily in shops, hotels and petrol stations. What’s cool is that you are immediately notified about all transactions by the app on your phone, how much and where you spend. The only situation when the payment was rejected was the purchase of fuel at an automatic gas station in Italy. Prepaid cards are sometimes also rejected in airplanes, where the system can not verify how much money we have in our account.

Revolut – what it is, how it works and how to use it – what to pay attention to!

Revolut is currently, in our opinion, the best option for abroad payments, but it is also not perfect. There are several situations where commissions are charged or costs are higher. The second issue is technical problems with the card. We have not met with them yet, but during the internet digging, we came across different opinions and cases. What should you remember?

- The prices of weekend currency conversions are higher than on weekdays. Usually, it is 0.5%. Although it is still lower than in a standard bank. In this way, the company hedges against exchange rate risk, because on weekends the interbank foreign exchange market does not operate.

- Additional commissions are charged if we pay in a currency that is not the same as it is: PLN, EUR, USD, GBP, CHF, AED, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MAD, NOK, NZD, QAR, RON, SEK, SGD, THB, TRY, ZAR. The commission is about 1%. Note: For Ukrainian, Russian and Thai currency the commission on weekends is 2%, and 1% per weekdays.

- If the terminal or ATM asks you to choose a currency, always choose the local currency of that country you are in.

- With Revolut card you will not be able to pay if cash is collected on an offline basis. Hence, for example, our problems at Italian stations. We will have a similar problem onboard an airplane.

- Withdrawals from Euronet ATMs in Poland are charged with an additional fee. We have not checked it, it is said to be quite high.

- Problems with the card localization function. It happened that the card was blocked because the system found that it had been stolen, even though it was still in the wallet. This great option, which increases security, however, it may be unreliable, so always carry a second card/cash, which you can use, because…

- … if we are used to the fact that you can call the hotline (sooner or later) and talk to a person who will solve our problems, or at least try to do so, then in the case of Fintech, a British company, we can only politely write about our problem and wait until the they answers.

REVOLUT – WHAT IT IS, HOW IT WORKS AND HOW TO USE IT – SUMMARY

Revolut is the best solution for us at the moment, but remember about its limitations and certainly not treat it as the only form of our holiday payments. We emphasize that this is a travel card, fund your account as much as you need. Do not treat Revolut as a normal account, do not keep your savings on it, we wrote about it earlier, but it is worth having it in your head – Fintech is a company, not a bank. If you have any experience with Revolut – let us know, it doesn’t have to be only the good one’s experience. If you want to use Revolut offer, create your own account and get your card for free, use our link.

A bunch of useful links at the end

- You’re packing your motorcycle for a vacation trip? Check to see if you have not forgotten anything and download our subjective guide.

- How much does the Green Card cost and in which countries is it necessary? You can find out everything from our article here.

Hi just reading about your service. How do we load in money for the card. Am I able to change to local currencies when traveling?

Hi Indra, you load money exactly the same way as you load an account on PayPal, through another card, bank transfer, etc. You can switch your balance to any currencies anytime.

In albania non e’possibile avere una Revolut Bank card

Purtroppo non tutti i paesi possono ordinare una carta Revolut 🙁 il sito web di Revolut elenca quelli in cui è possibile farlo. Recentemente anche un nostro amico messicano ha voluto ordinare una carta e ha avuto lo stesso problema.

Hi! Can I register if I’m living in Montenegro? I cannot find my country on the list in the application.

If your country is not on the list, then unfortunately, for the moment you will not order a Revolut card 🙁